2026 Investment Attraction Strategies

1. Strategic Positioning & Value Proposition (Core Foundation)

EDOs in 2026 compete on clarity, not incentives alone.

Key actions

- Define 3–5 priority sectors (e.g. fintech, advanced manufacturing, climate tech, life sciences).

- Build a place-based value proposition:

- Talent availability

- Cost advantage vs competitors

- Regulatory environment

- Time-to-market

- Translate this into investor language, not policy language.

Example

“Launch your UK fintech operations in 90 days with access to FCA-ready talent and 30% lower operating costs than London.”

2. Sector-Led Investment Targeting (Not “Spray & Pray”)

2026 best practice: target companies, not countries.

Key actions

- Build named account lists (50–200 firms per sector).

- Segment by:

- HQ country

- Growth stage (Series B–IPO)

- Expansion trigger (talent shortage, regulation, cost pressure)

- Align outreach with real expansion signals:

- Hiring surges

- New market announcements

- M&A activity

Tools

Internal CRM (HubSpot / Salesforce / Dynamics)

LinkedIn Sales Navigator

PitchBook / Crunchbase

FDI Markets

3. Investor-First Experience (Speed Is the New Incentive)

Top IPAs win on execution, not brochures.

Key actions

- Create a single investor concierge (one owner end-to-end).

- Pre-approved:

- Property options

- Workforce pipelines

- Visa / immigration pathways

- Grant eligibility

- Offer 48-hour response SLAs.

2026 expectation

If an investor waits 2 weeks, you’ve already lost.

4. Incentives That De-Risk, Not Just Discount

Smart incentives reduce risk, not just cost.

High-impact incentives

- Skills & training co-funding

- R&D collaboration grants

- Pilot / testbed access

- Fast-track planning & permitting

- Export / market-entry support

Avoid

- One-off cash grants with no clawbacks

- Incentives not tied to jobs, skills, or IP

5. Talent-Centric Investment Attraction

In 2026, capital follows talent—not the other way around.

Key actions

- Map skills supply vs sector demand.

- Partner with:

- Universities

- FE colleges

- Bootcamps

- Offer co-branded talent pipelines to investors.

Winning message

“We don’t just help you relocate — we help you hire 50 engineers in 12 months.”

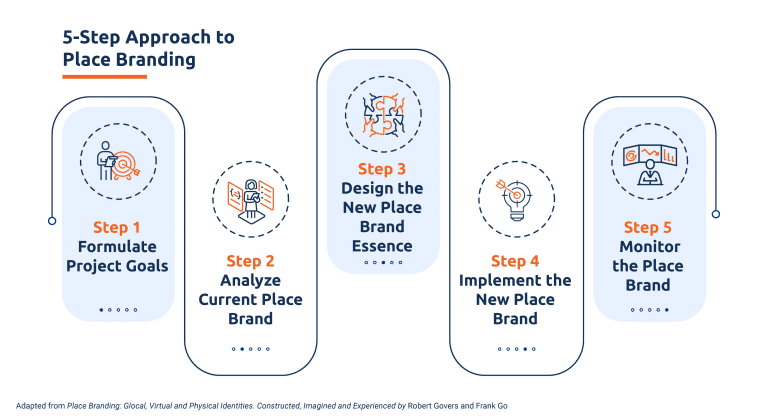

6. Place Branding & Storytelling (Evidence-Led)

Move beyond slogans. Investors want proof.

Effective content

- Case studies of landed investors

- Time-to-hire metrics

- Cost comparison calculators

- Short founder testimonials

- Sector-specific landing pages

Channels

- LinkedIn thought leadership

- Targeted investor microsites

- CEO-level roundtables (virtual & in-person)

7. Proactive Global Outreach & Partnerships

Modern IPAs co-sell with partners.

Key partnerships

- UK Department for Business and Trade

- OECD, EU, AU, ASEAN etc

- Chambers of Commerce

- Diaspora business networks

- Multinationals already in-region

Focus

Fewer trips, higher quality

Curated 1-to-1 meetings

Sector-specific missions

Need help with appointment setting? Let us know.

8. Data-Driven Investment Promotion (RevOps for IPAs)

2026 leaders run IPAs like revenue teams.

Track

- Investor pipeline stages

- Conversion rates (Lead → Landed)

- Jobs created per £ spent

- Time-to-decision

- Aftercare retention rate

Stack

Investor journey analytics

CRM (HubSpot / Dynamics)

BI dashboards

Need help setting up your RevOps stack? Contact us.

9. Aftercare & Expansion (Highest ROI Strategy)

Most new jobs come from companies already landed.

Key actions

- Annual C-suite check-ins

- Expansion readiness assessments

- Skills & automation support

- Supply-chain matchmaking

Mindset shift

Retention is investment attraction.

10. Sustainability & Impact-Led Investment

Capital in 2026 is increasingly ESG-screened.

Differentiate by

- Net-zero infrastructure

- Green energy access

- Social value commitments

- Impact measurement frameworks

Summary: 2026 Winning Formula for EDOs

High-performing investment agencies:

Treat investors like long-term clients

Are sector-focused

Operate like RevOps teams

Sell speed, talent, and certainty

Measure outcomes, not activity