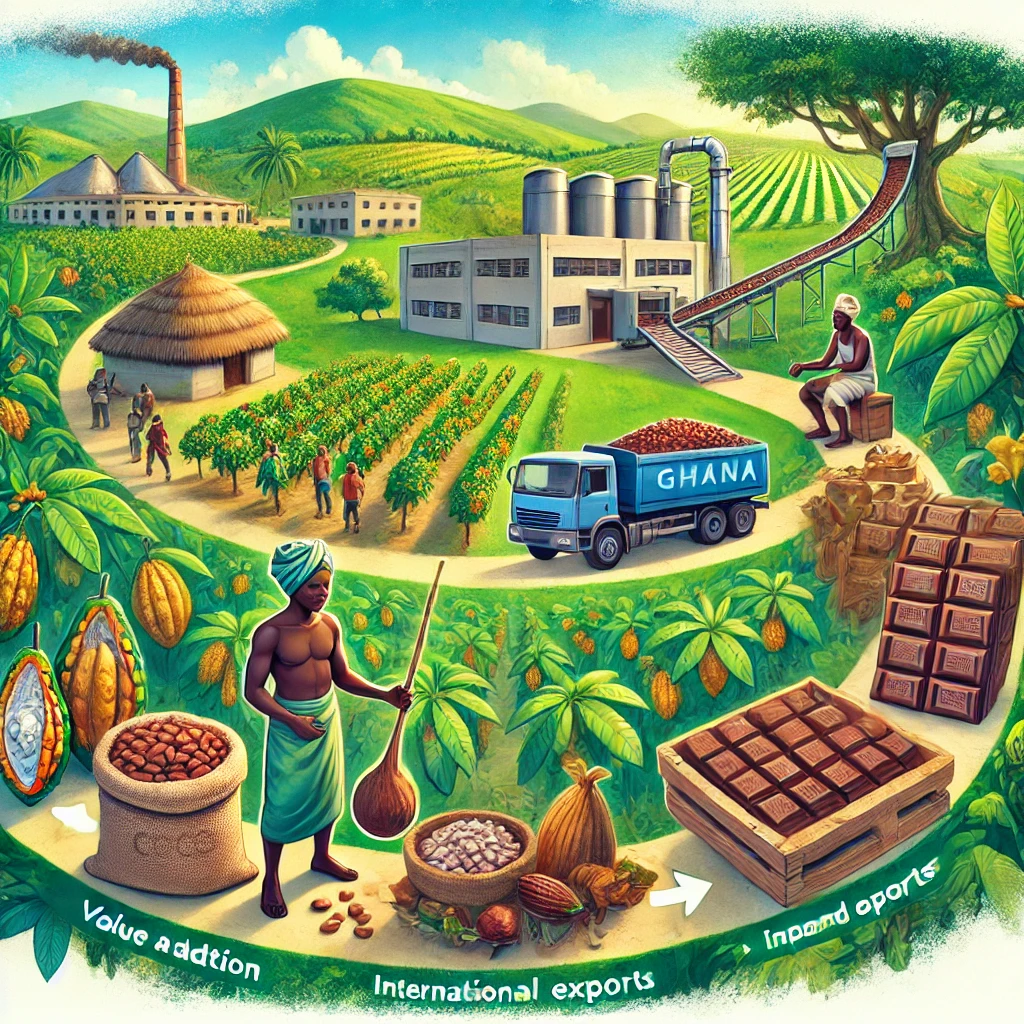

How Ghana can move up the Cocoa Value Chain.

Ghana stands at a pivotal moment in its cocoa industry. As the world’s second-largest cocoa producer, the nation has the opportunity to move beyond raw bean exports and take a leading role in the global cocoa value chain. This document explores Ghana’s historical and current cocoa production trends, analyses the challenges and opportunities within the industry, and proposes actionable strategies to increase value addition, ensuring a sustainable and prosperous future for the sector.

A Historical Overview of Cocoa Production in Ghana

Ghana has a storied history as one of the world’s leading cocoa producers. Introduced to the country in the late 19th century, cocoa quickly became a cornerstone of Ghana’s economy. By the mid-20th century, Ghana was the largest cocoa producer globally, contributing over 30% of the world’s cocoa supply. However, this dominance waned due to challenges such as pest infestations, ageing farms, price volatility, and competition from other producers like Ivory Coast and Indonesia. Despite these setbacks, cocoa remains vital, accounting for 20-25% of Ghana’s export earnings.

Current Cocoa Production Trends

Ghana is currently the second-largest cocoa producer in the world, contributing approximately 15-20% of global supply. The nation produces around 800,000 to 1,000,000 metric tonnes annually, with significant improvements in yield due to government initiatives such as improved seedlings and fertiliser distribution. However, the sector faces challenges such as climate change, deforestation, and low farmer incomes.

Cocoa Prices vs. Production (1970-2023)

Over the past 50 years, cocoa prices have experienced significant volatility, influenced by global demand, weather patterns, and economic conditions. In the 1970s, cocoa prices averaged around $4,000 per tonne (adjusted for inflation), declining sharply during the 1980s and 1990s to lows of approximately $1,000-$2,000 per tonne. In recent years, prices have stabilised around $2,400-$3,000 per tonne. Ghana’s production has generally trended upwards, but the correlation between production and revenue has been weakened by price fluctuations, compounded by Ghana’s limited value addition.

SWOT Analysis of Ghana’s Cocoa Industry

Strengths:

- Established a reputation as a producer of high-quality cocoa.

- Strong institutional support, including the Ghana Cocoa Board (COCOBOD).

- A significant contribution to rural livelihoods and the national economy.

Weaknesses:

- Dependence on raw cocoa exports.

- Limited processing capacity within the country.

- Low farmer incomes and reliance on subsistence farming.

Opportunities:

- Increasing global demand for ethically sourced and high-quality chocolate.

- Opportunities to expand processing and manufacturing capacities.

- Potential for organic and premium cocoa production.

Threats:

- Climate change and its impact on cocoa-growing regions.

- Competition from emerging producers.

- Dependence on volatile global commodity markets.

Opportunities for Ghana

- Processing and Manufacturing: Ghana can significantly increase revenue by expanding domestic cocoa processing. Currently, less than 30% of Ghana’s cocoa is processed locally. Investment in factories to produce cocoa butter, powder, and finished goods like chocolate can capture more value.

- Premium and Organic Markets: With growing consumer demand for ethically sourced and organic chocolate, Ghana can position itself as a leader in these niche markets.

- Tourism and Branding: Developing chocolate tourism—including factory tours and festivals—can further enhance Ghana’s global reputation.

- Trade Agreements: Leveraging trade agreements like the African Continental Free Trade Area (AfCFTA) can help Ghana access new markets.

SWOT Analysis of the Global Cocoa Market

Strengths:

- Cocoa is a critical raw material for the thriving global chocolate industry, valued at over $150 billion.

- Increasing consumer demand for premium and ethical chocolate products.

- Widespread global consumption, with Europe, North America, and Asia being key markets.

Weaknesses:

- High vulnerability to climate change affecting cocoa production regions.

- Fragmented supply chains leading to inefficiencies.

- Low farmer incomes in producing countries affecting sustainability.

Opportunities:

- Expansion of organic and fair-trade cocoa products to meet growing ethical consumerism trends.

- Innovations in cocoa processing and chocolate manufacturing.

- Emerging markets in Asia and Africa driving new demand for cocoa-based products.

Threats:

- Price volatility in global markets impacting revenue stability for producers.

- Competition from synthetic substitutes and alternative plant-based ingredients.

- Regulatory challenges related to environmental sustainability and labour practices.

Threats to Avoid

- Over-reliance on Export Markets: Fluctuating global prices make reliance on raw cocoa exports risky.

- Deforestation and Climate Risks: Unsustainable farming practices threaten the long-term viability of cocoa production.

- Limited Investment in Technology: Failing to adopt modern farming and processing technologies could hinder competitiveness.

Revenue Analysis (1970-2023)

Ghana’s cocoa export revenue has grown significantly in nominal terms, from approximately $200 million in the 1970s to over $3 billion in recent years. However, adjusted for inflation, real growth has been constrained by price volatility and limited value addition. The potential to process and export finished goods could more than double revenue over the next decade.

The Global Chocolate Industry

The global chocolate industry is valued at over $150 billion, with significant demand in Europe, North America, and Asia. This value has grown steadily over the decades, driven by increasing consumer demand for premium and artisanal chocolates, expanding middle classes in emerging markets, and innovations in product offerings. In 1980, the global market value was approximately $20 billion, growing to $70 billion by the early 2000s, and surpassing $150 billion in the 2020s. Factors such as marketing innovations, seasonal demand spikes, and the rise of ethical consumerism have also contributed to this growth.

Consumer trends are increasingly shaping the market, with a noticeable shift toward vegan, sugar-free, and organic chocolate products. Health-conscious consumers are demanding lower-calorie and dairy-free options, prompting manufacturers to innovate and diversify their offerings. These trends not only cater to dietary preferences but also align with broader environmental and ethical considerations, appealing to a growing segment of conscientious consumers.

Market Share of Major Players:

- Mars, Inc.: Estimated annual revenue of $20 billion, accounting for around 13% of the global market.

- Nestlé: With brands like KitKat and Smarties, generates approximately $10 billion from chocolate, holding a 6-7% market share.

- Mondelez International: Owner of Cadbury and Milka, commands a 10% market share with revenues of $15 billion.

- Ferrero Group: Known for Nutella, Ferrero Rocher, and Kinder, holds around 9% market share with annual chocolate sales of $13 billion.

- Hershey Company: Focused on North America, has an 8% market share, generating around $12 billion annually.

Smaller players, including artisanal brands and regional companies, collectively hold approximately 30% of the market, reflecting the growing consumer appetite for niche products.

The global chocolate industry is valued at over $150 billion, with significant demand in Europe, North America, and Asia. This value has grown steadily over the decades, driven by increasing consumer demand for premium and artisanal chocolates, expanding middle classes in emerging markets, and innovations in product offerings. In 1980, the global market value was approximately $20 billion, growing to $70 billion by the early 2000s, and surpassing $150 billion in the 2020s. Factors such as marketing innovations, seasonal demand spikes, and the rise of ethical consumerism have also contributed to this growth.

Market Share of Major Players:

- Mars, Inc.: Estimated annual revenue of $20 billion, accounting for around 13% of the global market.

- Nestlé: With brands like KitKat and Smarties, generates approximately $10 billion from chocolate, holding a 6-7% market share.

- Mondelez International: Owner of Cadbury and Milka, commands a 10% market share with revenues of $15 billion.

- Ferrero Group: Known for Nutella, Ferrero Rocher, and Kinder, holds around 9% market share with annual chocolate sales of $13 billion.

- Hershey Company: Focused on North America, has an 8% market share, generating around $12 billion annually.

Smaller players, including artisanal brands and regional companies, collectively hold approximately 30% of the market, reflecting the growing consumer appetite for niche products.

Key Players in the Cocoa Supply Chain

- Farmers: Produce raw cocoa beans.

- Local Buyers: Purchase cocoa from farmers for exporters or processors.

- Exporters: Facilitate international trade.

- Processors: Convert beans into butter, powder, and liquor.

- Manufacturers: Create finished products like chocolate bars and confectionery.

- Retailers: Sell products to consumers.

Strategies for Moving Up the Value Chain

- Investment in Processing Infrastructure: Build modern processing plants to produce semi-finished and finished goods. For instance, Ivory Coast has successfully increased its domestic processing capacity, now processing over 40% of its cocoa production, which has significantly enhanced its revenue.

- Skills Development: Train local entrepreneurs and workers in chocolate-making and branding. Indonesia, for example, has invested in local training initiatives, enabling small-scale producers to enter premium markets.

- Marketing and Branding: Develop strong Ghanaian chocolate brands for the global market. Ecuador’s emphasis on branding its fine flavour cocoa has earned it a reputation for premium chocolate globally, commanding higher prices.

- Public-Private Partnerships: Collaborate with private investors and international partners to boost capacity. Brazil’s partnerships with private processors have increased its capacity to produce semi-finished goods like cocoa butter and liquor.

- Support for Farmers: Ensure fair pricing, access to financing, and incentives for quality improvements. For example, Peru’s focus on organic and fair-trade certification has helped its farmers secure premium prices in international markets.

- Investment in Processing Infrastructure: Build modern processing plants to produce semi-finished and finished goods.

- Skills Development: Train local entrepreneurs and workers in chocolate-making and branding.

- Marketing and Branding: Develop strong Ghanaian chocolate brands for the global market.

- Public-Private Partnerships: Collaborate with private investors and international partners to boost capacity.

- Support for Farmers: Ensure fair pricing, access to financing, and incentives for quality improvements.

Potential Revenues from Value Addition

If Ghana processes 50% of its annual cocoa output into finished goods, it could increase revenues from $3 billion to over $10 billion annually. Finished products can be broadly categorised into premium chocolates, mass-market chocolates, cocoa butter, cocoa powder, and liquor. Premium chocolates, which include artisanal and organic varieties, command higher prices and contribute significantly to revenue, potentially adding $4 billion annually if Ghana captures a share of this market. Mass-market chocolates, with their broader consumer base, can add another $2 billion. The remaining $1 billion can come from semi-finished products like cocoa butter and powder sold to international manufacturers. Diversifying product offerings to include premium and artisanal chocolates could further boost revenue while aligning with global consumer trends.

If Ghana processes 50% of its annual cocoa output into finished goods, it could increase revenues from $3 billion to over $10 billion annually. Diversifying product offerings to include premium and artisanal chocolates could further boost revenue.

Conclusion

Ghana’s cocoa industry is at a crossroads. By transitioning from a raw material exporter to a producer of finished goods, the country can unlock significant economic opportunities. Through strategic investments, market positioning, and value addition, Ghana can retain more wealth within its borders and secure a sustainable future for its cocoa industry.